Learn from Financial Experts

Our budget essentials program connects you directly with seasoned financial professionals who bring decades of real-world experience to every lesson.

Meet Your Financial Mentors

Each instructor brings unique expertise from different areas of financial services, ensuring you get well-rounded perspectives on budget management and financial planning.

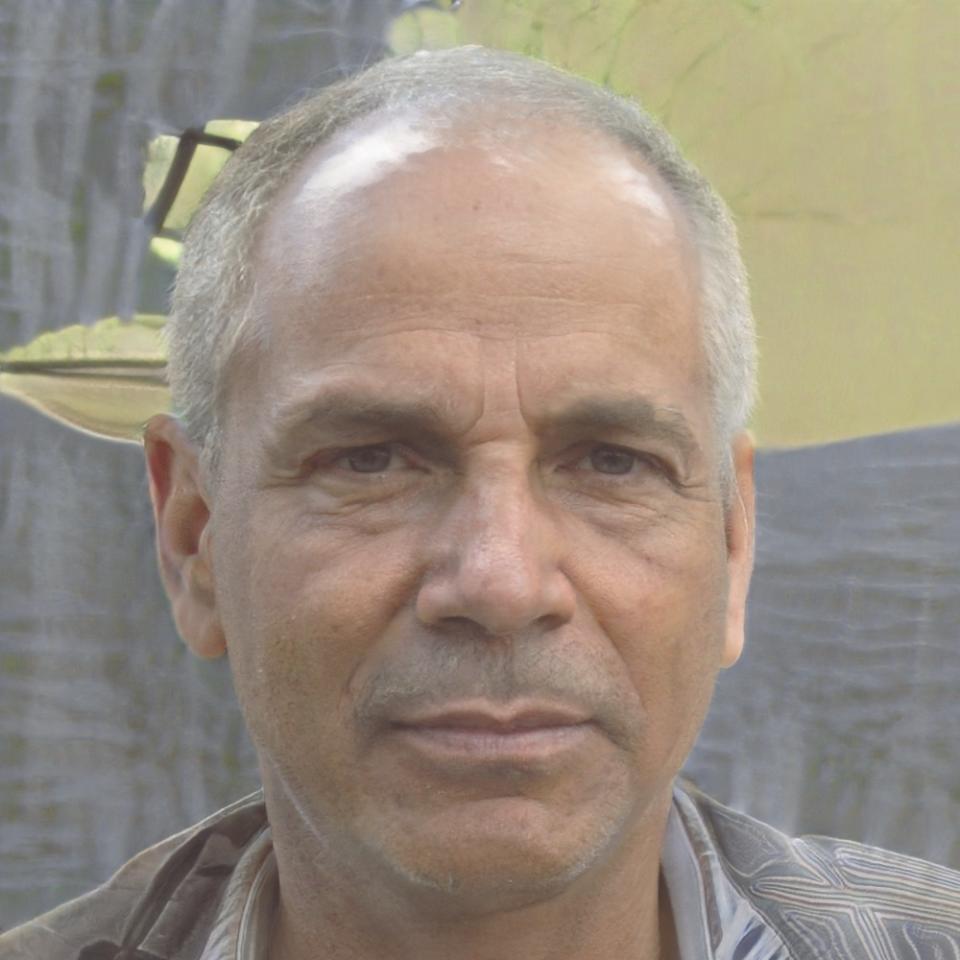

Cassius Thornfield

Senior Budget Analyst

Cassius spent 18 years helping Canadian families navigate complex financial situations. His approach focuses on practical budget strategies that actually work in day-to-day life. He's particularly good at breaking down complicated financial concepts into manageable steps.

Seraphina Blackwood

Financial Planning Specialist

Before joining our team, Seraphina worked with credit unions across Quebec, specializing in debt management and savings strategies. She has a talent for helping people see their complete financial picture and create realistic long-term plans.

Octavius Grimwell

Investment Education Director

Octavius brings a unique perspective from his background in both traditional banking and financial education. His sessions focus on building solid financial foundations before exploring any investment opportunities. He's known for his patient, methodical teaching style.

Bartholomew Ashworth

Behavioral Finance Coach

What makes Bartholomew different is his focus on the psychology behind spending decisions. He helps students understand why they make certain financial choices and develops personalized strategies to build better money habits over time.

How Our Experts Teach

- Small group discussions where you can ask questions about your specific financial situation

- Real case studies from our instructors' professional experience (with privacy protection, of course)

- Hands-on budget creation workshops using actual Canadian cost-of-living data

- One-on-one mentorship sessions to review your personal financial goals

- Interactive exercises that simulate real-world financial decision-making scenarios

- Weekly check-ins to track your progress and adjust your learning path as needed

Your Expert Guidance Journey

Our structured approach ensures you build financial knowledge progressively, with expert support at every stage.

Assessment & Goal Setting

Your assigned mentor conducts a comprehensive review of your current financial situation and helps you establish realistic, achievable objectives for the program.

Personalized Learning Path

Based on your assessment, our experts design a customized curriculum that addresses your specific financial challenges and learning preferences.

Ongoing Mentorship

Regular one-on-one sessions with your mentor ensure you're applying concepts correctly and making steady progress toward your financial goals.